The Gamification of Trading

Stock Specific Volatility, Carole Baskin, and GameStop made for one crazy week

Over the last six weeks I’ve gone from a professional market maker on the floor of the NYSE to the other side of the arena. For the time being, I’m playing the home game version. This version has it all. Access to any stock I want, no dress code, chat rooms, FinTwit personalities, live conversations with other home gamers and at times - total chaos.

That chaos has been on full blown display in 2021.

Before I elaborate, let’s go back in time for reference. When I started in the business we were trading in eighths. Remember fractions? Stocks were less volatile and more liquid as a result. Over time markets evolved; spreads narrowed and technology improved how we access and interact with markets.

The cost of trading went down dramatically as well. On-line trading exploded onto the scenes in the 90’s. Firms like Datek, National Discount Brokers, DLJ Direct and E-Trade helped bring the cost of a trade down to roughly $9.99 per execution. For less than the cost of a CD (Compact Disc kids) you could own a stock.

The biggest retail operations in Vanguard, Schwab, and Fidelity all fell in line. It was now cheaper and easier for the average investor to get involved. This was game changing at light speed. A new wave of traders entered the battlefield.

Clearly, you know where this is heading. As Robinhood and it’s zero fee trading started to gain a presence within the industry, others followed suit. In October 2019, Schwab, E-Trade and TD Ameritrade announced they to would no longer charge for individual stocks, ETF’s and options trades. The floodgates were officially open - ludicrous speed ahead!

Trading is essentially free for all and now it’s become an all out free-for-all. Yet, we needed a catalyst to really get this party started. What could it be? How about a global pandemic that crashes the market, shuts down sports and quarantines everyone to their homes? In fact, let’s make it better - give everyone a “stimulus” check.

LET’S PLAY!

Since Covid we’ve seen the advent of Davey Day Trader, TikTok Investors and pockets of individual stocks routinely moving 10-20% IN A DAY. For a long term investor a 10% gain in a year is considered above average. In 2020/21, if you can’t find the 10% winner each day you feel as if you are out of touch.

The rotation from sector to sector and stock to stock is like watching a sporting event. We are all at this tennis match trying to keep our eye on the ball.

First, we hit the FAANG stocks.

Now focus on the work from home stories.

OK, go back to cruise ships and airlines.

Wait, we need to speculate on vaccine makers. Good point, but don’t forget all the IPO’s.

IPO’s are great, but can we spice it up a bit? Heck yeah - have you seen these SPAC’s?

Nice! What else you got? Bitcoin! Please stop - this is about stocks.

How about what’s old is new again? Grab me some GM, Ford, GE and US Steel.

What’s been asleep for a long time? Glad you asked. Let me reintroduce you to the financials and oil sector. Sweet!

What about the election results? Let’s chase alternative energy, electric vehicles and pot stocks.

What if there’s chaos around the election? No problem - gun stocks.

There’s always an opportunity and something new. This week I learned some of those new things.

GAME ON!

So what was new this week? What stocks did people play?

Exhibit A..

That’s Carole Baskin of Tiger King and Dancing with the Stars fame. She was paid $299 to film a Cameo where she mentioned a penny stock called Zomedica. The video went viral amongst the trading community and the stock soared. It was up 230% on a billion shares the day it aired.

I don’t know if this was genius, criminal or criminally genius. To me, it was a new and clever version of the old pump and dump. It made Zomedica ($ZOM) the game of the day. It was stunning to see how many people got swept into the action and traded based on this.

As for Carole Baskin’s involvement, she had no idea what she was doing. She got paid like other celebrity endorsers to read what that asked. She did comment on the situation - “ I don't hold any stock in the company and don't make stock recommendations”. I believe her, although I still think she killed her husband.

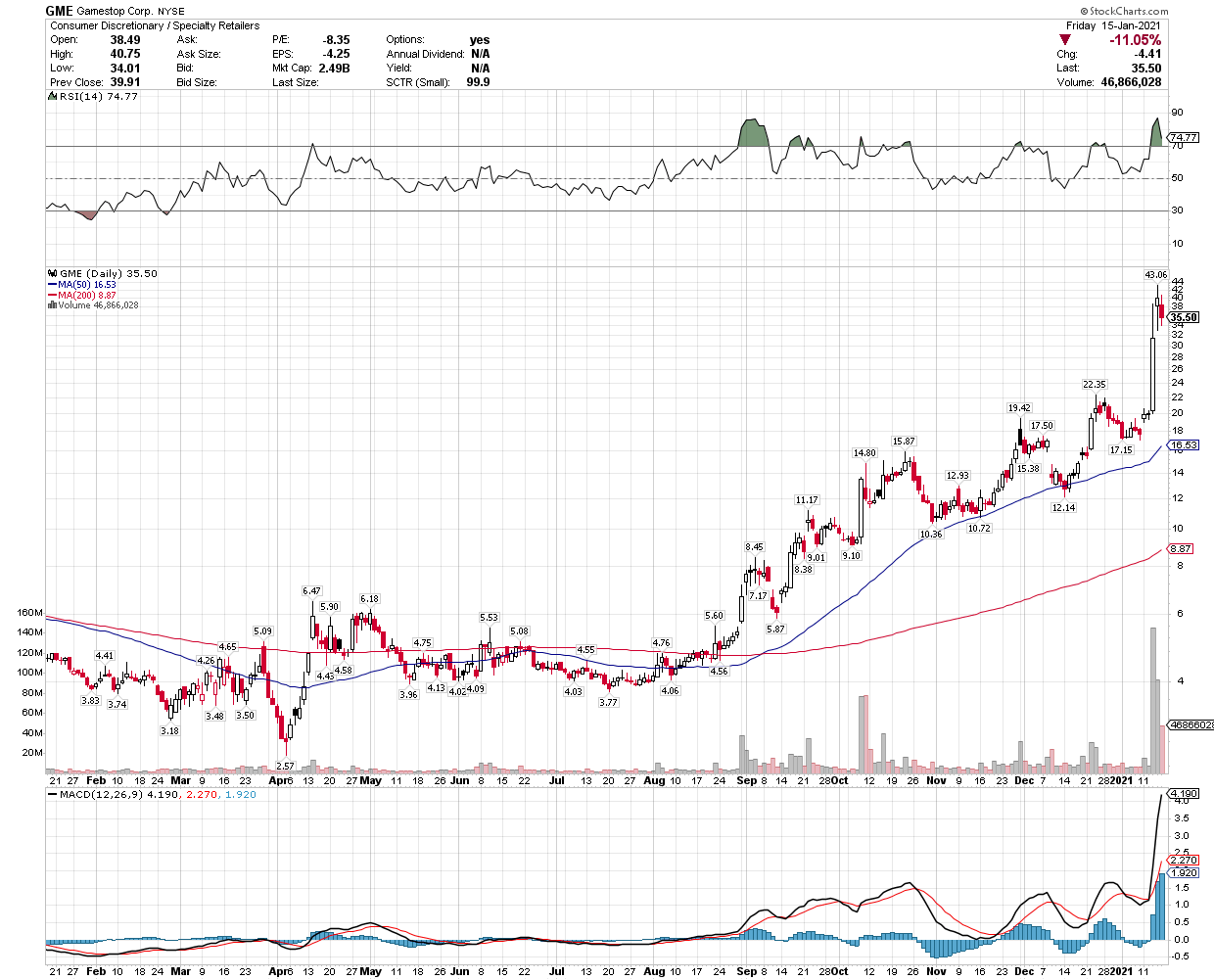

Exhibit B.. The Storming of GameStop ($GME)

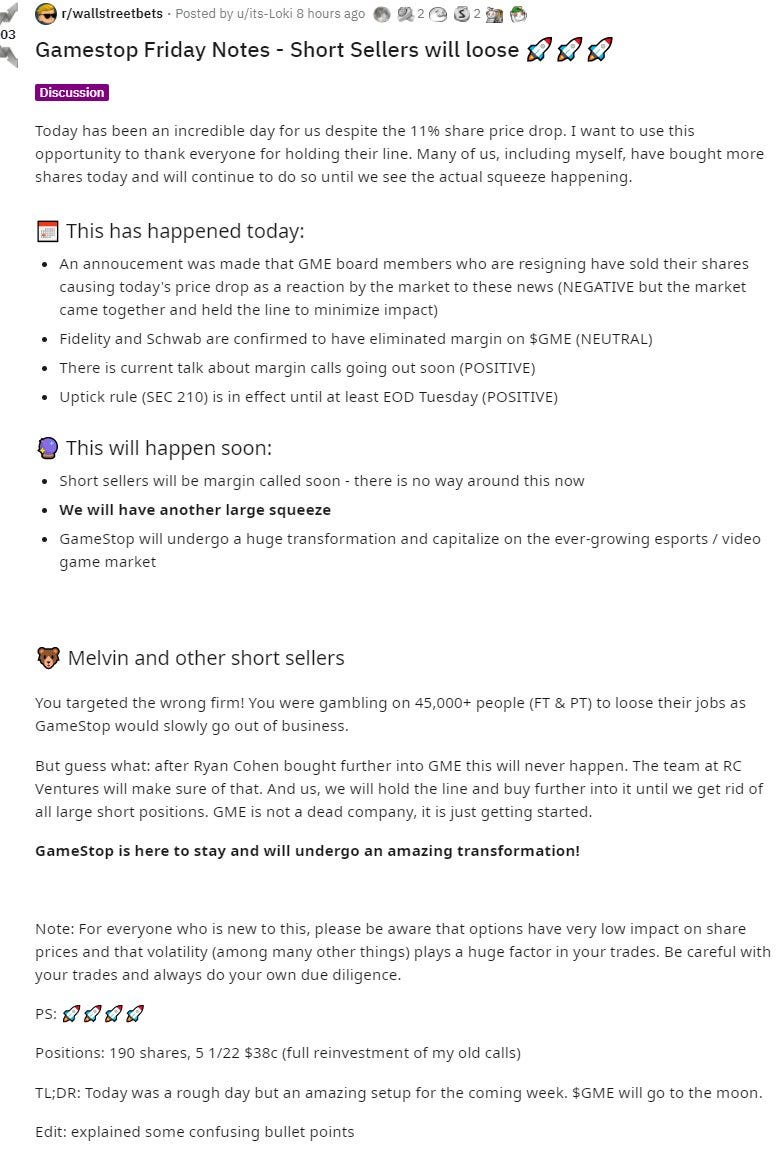

This week saw shares of heavily shorted and beaten down stocks like $GME and $BB soar after much hype on social media. In particular, Reddit’s WallStreetBets forum exploded with talk about an epic short squeeze in GameStop. They correctly noted it was one of the most shorted stocks on the NYSE. A rally could make shorts scramble to meet margin calls and cover. The stock would obviously rally. That thought along with a very positive reaction to news that Chewy founder, Ryan Cohen, took a 9% stake in the company caused a massive run up in shares.

The messages about $GME read like a plan to storm the Capitol. They were organized, prepared and came for the stock in waves. The run up became the buzz of both financial and social media. The shorts had to the cover and the stock erupted.

The chatter than spread to other heavily shorted names like Blackberry (the official phone of CNBC’s Bill Griffeth) and Bed Bath and Beyond. Both stocks rallied, but nothing like GameStop.

Exhibit C.. My teenage son, Kevin

Kevin is the stereotypical GenZ kid that thinks that trading is easy. When he isn’t in his room gaming with friends or in virtual school, he will swing by to check out the market.

I like it and he seems to be learning a lot. We even started a small trading account that I manage for him on Public.com. In two weeks he’s up 9.2%! (Yes, $TSLA is one of his 9 holdings) He even entered a trading contest that Ritholtz Wealth Management is running. So he’s following things closely.

As he passed by yesterday, he yelled, “Dad, buy 50 shares of BABA right now”. I thought maybe he had a scoop as to where Jack Ma was. Sadly, he had nothing.

I asked why and what’s our time frame. He replied, “just because”. This is not the logic I am trying to teach him, but it’s a game to him and I obliged. If I didn’t and the stock went up, I would never hear the end of it.

The holding period was 10 minutes. Exactly the time he had for his school lunch break. I assumed he wanted to go back to brag to his friends about being a great “stock man”. I was right.

The stock rallied from $243.35 to $243.83. A .48 gain on 50 shares to give him a profit of $24. Chipotle and Starbucks here he comes!

He didn’t want to hear that I had to put out $12,000 for that “little” trade. I know for sure he didn’t want to hear about when I was a young trader it would have cost me $9.99 to execute both the buy and the sale of that trade.

He thinks and acts like many of the other traders I’m encountering on the home version. He likes to game. He’s internet savvy and communicates to all his friends without leaving his room. He’s a modern day social butterfly.

Like Kevin, many of the new traders treat the markets as just a game. It’s exciting to be involved, but as I witnessed recently, it’s a game that they are taking to new levels every week. Who knows what’s next?

If you want to see more about the GameStop story, Katherine Ross interviewed Jim Cramer about the situation here. The Wall St Journal also wrote about it here. H/T Jackie Cartwright for the added intel.

Thanks for reading. Don’t hesitate to like, comment or share.

Dear Trader Jay.... Longtime reader, first time commenter. Those of us who’ve attended a few rodeos have seen this before. Only the names of the stocks change. And it never ends well. Ever. By the way, for the umpteenth time, I now own an iPhone.

Jay Woods bringing the Goods! Doug from HoHoKus would be proud! Greetings from your fellow FU Ram and former Walsh Hall roommate! I will mash that subscribe button and follow along on your new adventure. Best of Luck! Pat